📢 Highlights

Open-Source Medical AI Finally Arrives As Google's Gift to Healthcare Developers

Microsoft's BioEmu Turns Protein Movies From Million-Dollar Productions to Desktop Features

Revolution Medicines Bets $25M That Iambic's AI Can Crack "Undruggable" Cancer Targets

Not yet a member of our super awesome slack community of ~10,000? Join HERE 🤗

👀 In Case You Missed it …

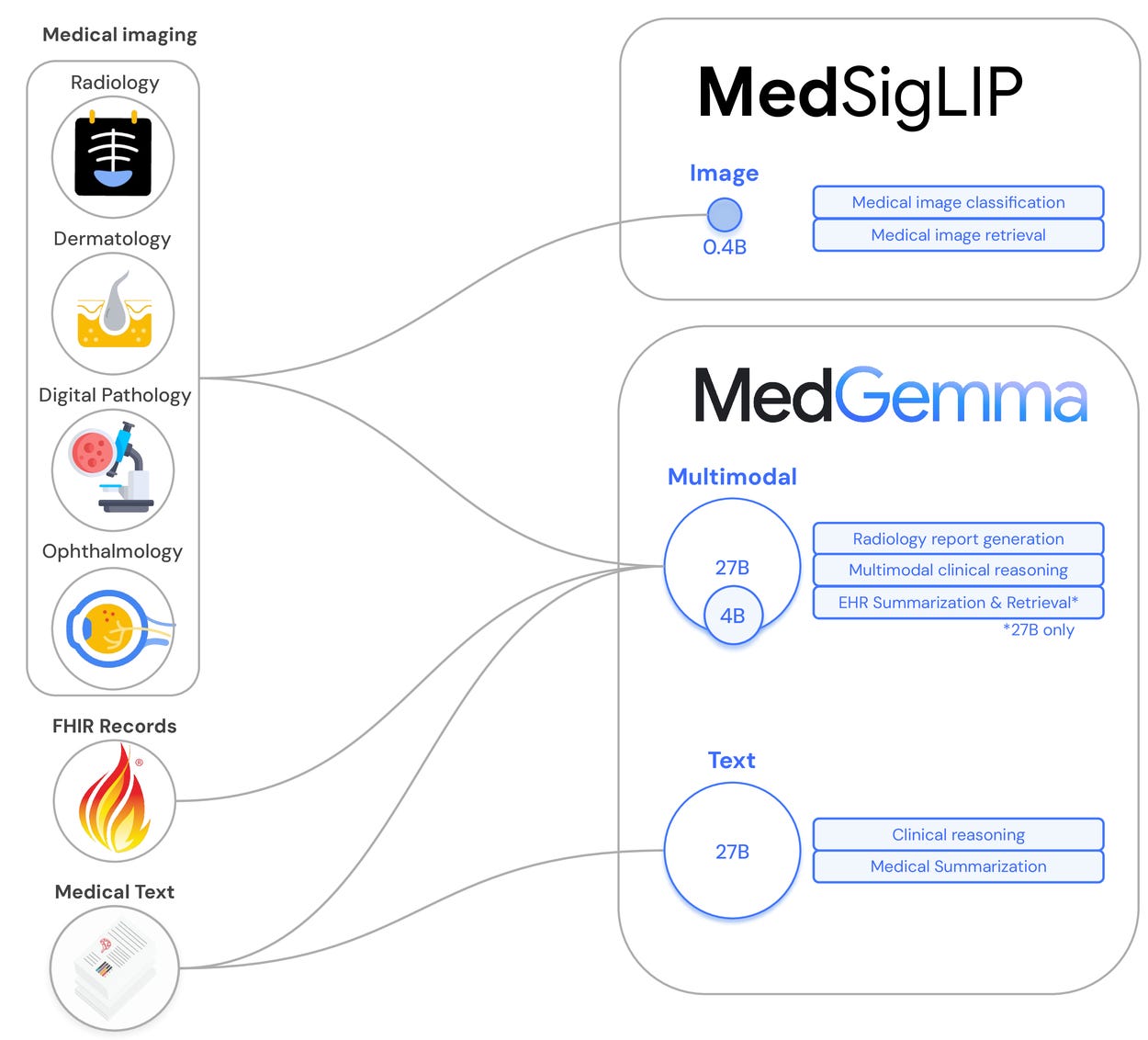

Google releases MedGemma and MedSigLIP, open medical AI models, targeting healthcare application development

Google has open-sourced Med-Gemma, a family of instruction-tuned LLMs trained specifically on biomedical and multimodal medical tasks. Built on Gemma 3, the famlily includes a 4B multimodal version, a 27B text-only variant, and a new 27B multimodal model designed for complex EHR interpretation. The models deliver impressive benchmarks: MedGemma 27B scored 87.7% on MedQA (within 3 points of the much larger DeepSeek R1), while the 4B multimodal version hit 64.4%—top of its weight class. Most notably, when board-certified radiologists reviewed chest X-ray reports generated by MedGemma 4B, they judged 81% sufficient for guiding actual patient management. Alongside MedGemma, Google released MedSigLIP, a lightweight 400M parameter image encoder that powers the visual capabilities and can run on mobile hardware. The models were trained on de-identified medical data spanning radiology, pathology, ophthalmology, and dermatology images, with careful retention of general capabilities—meaning they can handle mixed medical and non-medical queries without breaking a sweat. Available under Google's Health AI Developer Foundations framework, these aren't meant for direct clinical use but as starting points for developers building the next generation of medical AI applications. The models are released with weights, training data stats, and fine-tuning code, find it all at their github.

Microsoft Research releases BioEmu, an AI system that generates dynamic protein ensembles

Microsoft Research AI for Science has introduced BioEmu, a deep learning system that generates thousands of statistically independent protein structures per hour on a single GPU—a dramatic leap from traditional molecular dynamics simulations that require massive computational resources. The system integrates over 200 milliseconds of MD simulations, static structures, and experimental protein stabilities to capture diverse functional motions including cryptic pocket formation, local unfolding, and domain rearrangements. Compared to millisecond-scale MD simulations, BioEmu claims to provide 10,000-100,000x computational efficiency gains with industry leading accuracy. The tool addresses a fundamental challenge in structural biology: while AlphaFold revolutionized single-structure prediction, proteins are inherently highly dynamic molecules that adopt multiple conformations crucial for function - many larger proteins are often best visualized as vibrating viscoelastic masses rather than the static and rigid structures they are frequently depicted as. Microsoft has made BioEmu open-source and available through Azure AI Foundry Labs, complete with the largest sequence-diverse protein simulation dataset ever released publicly. The approach could accelerate drug discovery by enabling rapid exploration of protein conformational landscapes that were previously computationally prohibitive. Early applications demonstrate the system's ability to predict both bound and unbound structures of proteins not present in training data, offering mechanistic insights into protein function. However, wet lab validation will be needed to evaluate its merits. Find more on their github.

Behind the Deal: Revolution Medicines Taps Iambic’s AI Platform in $25M Oncology Tie-Up

Revolution Medicines has inked a discovery-stage deal with AI-native Iambic, betting on the startup’s generative chemistry engine to accelerate drug design for undisclosed oncology targets. The agreement includes upfront and near-term R&D payments totaling up to $25M. Iambic (formerly Entos) has built PropANE, a structure-based design platform combining graph neural networks with quantum mechanics-informed modeling. It’s designed to predict potency, selectivity, and developability in silico—compressing early-stage timelines and reducing the need for iterative lab work. The company has advanced internal programs against KRAS, EGFR, and HER2 using the same engine.

Under the deal, Revolution gets access to PropANE and will take forward selected compounds into preclinical and clinical development. Iambic retains rights to its core platform and can apply learnings across programs. This follows Iambic’s recent partnership with AbbVie and reflects a broader shift in how AI tools are being integrated: not as end-to-end pipelines, but as modular infrastructure to support more efficient discovery.The announcement comes amid increasing pressure on biotechs to improve R&D efficiency, especially in early discovery. Platform-native players like Iambic, Recursion, and Isomorphic are aiming to make AI a standard part of the drug discovery stack—not a science project.Revolution’s bet suggests growing pharma appetite for tech-driven, target-specific discovery models. The question now is whether in silico predictions can consistently translate into clinical winners.

Imperial researchers launch BAGEL framework to democratize protein engineering beyond current AI limitations

Researchers at Imperial College London have introduced BAGEL (Protein Engineering via Exploration of an Energy Landscape), a modular, open-source Python framework that aims to make protein design more flexible and accessible than current deep learning approaches. Published on bioRxiv, the work addresses a key limitation in computational protein design: existing pipelines are rigid, highly specific, and poorly suited for non-differentiable or multi-objective design goals. BAGEL formalizes protein design as the sampling of an energy function composed of user-defined terms capturing geometric constraints, sequence embedding similarities, or structural confidence metrics. The framework is model-agnostic and gradient-free, providing researchers with alternatives to the fixed-backbone and inverse-folding paradigms that dominate current protein design. Led by Jakub Lála, Ayham Al-Saffar, and Dr. Stefano Angioletti-Uberti from Imperial's Department of Materials, BAGEL natively supports multi-state optimization and advanced Monte Carlo techniques. The framework is available on github.

FDA Rejects Capricor's DMD Cell Therapy Despite Priority Review Status

In a surprising turn, the FDA has rejected Capricor's biologics license application for deramiocel—an allogeneic cardiosphere-derived cell therapy for Duchenne muscular dystrophy cardiomyopathy—stating it doesn't meet statutory requirements for substantial evidence of effectiveness. The decision comes as a surprise to the company, which had received priority review status in March and successfully completed pre-licensure inspections without major deficiencies identified. Deramiocel showed sustained improvements in upper-limb strength and preserved left ventricular ejection fraction in the Phase II HOPE-2 trial and its three-year open-label extension, but the FDA wants additional clinical data. The rejection coincides with broader FDA leadership changes—former cell and gene therapy chief Nicole Verdun was reportedly put on administrative leave weeks before the decision, and a planned advisory committee meeting was cancelled. Capricor's stock plummeted 40% in premarket trading, though the company expects Phase III HOPE-3 results from 104 patients in Q3 2025 that could potentially address the FDA's concerns. The setback adds to mounting challenges in the DMD space, following similar recent rejections for other experimental therapies, made all the more daunting by a concerning picture or the FDA's unpredictability and organizational inconsistency as it re-defines itself.

China's share of global biotech outlicensing deals jumps to 32% as US pharma hunts for affordable pipeline fills

Chinese biotechs are reshaping the global biopharma landscape, capturing 32% of outlicensing deal value in Q1 2025 versus 21% in both 2024 and 2023, according to a new Jefferies report. The surge reflects mounting pressure from patent expirations and potential drug pricing decreases, driving multinational corporations to seek affordable pipeline solutions from China's rapidly maturing biotech ecosystem. Bristol Myers Squibb, Roche, and Merck are the most active shoppers, while Bristol Myers, Pfizer, and Gilead top the spending charts. Since 2022, Chinese biotechs have developed 639 first-in-class drug candidates—a staggering 360% increase from 2018-2021—significantly outpacing the 100-150% growth seen in the US, Europe, and Japan. The deals also come with attractive economics: upfront payments are typically 60-70% smaller than global peers, and China's accelerated timelines and cheaper development costs make it an increasingly compelling sourcing destination. Despite ongoing BIOSECURE Act concerns, analysts believe the economics are too compelling for US companies to ignore.

ScienceMachine raises $3.5 M to scale “Sam” an autonomous bioinformatics AI

London-based bioinformatics startup ScienceMachine has closed a $3.5M pre-seed, led by Revent and Nucleus Capital. The company has developed "Sam," an AI bioinformatician that operates continuously—handling everything from data cleaning to exploratory analysis to visualization and insight extraction without human intervention. Sam is already in production with biotech clients, reportedly delivering output equivalent to full data‑science teams at around one‑third the cost and in a fraction of the time. By integrating directly with lab pipelines and databases, it addresses a very real bottleneck in R&D: too much data, too few experts. Early users have testified to experiencing faster cycles measured in hours (not months), resulting in improved quality at lower cost. What's particularly striking is ScienceMachine's execution velocity—they've achieved production-level AI automation and secured multiple contracts within a month of launch, all without any obvious marketing spend. The funding will fuel recruitment, product development, and outreach into larger biopharma as Sam blurs the line between automated pipelines and true scientific assistants. While the promise of truly autonomous biotech analysis is compelling, the real test will be whether Sam can maintain its performance across the diverse and often messy realities of pharmaceutical R&D at scale, and at a price-performance level equal to or greater than the potent competition from the likes of Future House and Stanford's Biomni team.

Cash-strapped RallyBio sells stake in promising bone disease program to Recursion Pharmaceuticals for $25M

New Haven-based RallyBio has sold its interest in REV102, a preclinical ENPP1 inhibitor for the rare bone disease hypophosphatasia, to AI-driven partner Recursion Pharmaceuticals for up to $25 million in a strategic move to extend its cash runway into mid-2027. The deal includes $7.5 million upfront in equity (with price protection mechanisms), plus potential milestones of $12.5 million for additional preclinical studies and $5 million for Phase 1 initiation. REV102 represents the first potential oral disease-modifying treatment for hypophosphatasia patients, who currently rely on AstraZeneca's injectable Strensiq—a significant market opportunity that RallyBio is now walking away from. The divestiture follows a challenging period for the biotech, which discontinued its lead FNAIT program in April and has reduced its workforce by 40% since suffering a Phase 2 setback. RallyBio will now focus resources on RLYB116, a differentiated C5 inhibitor targeting complement dysregulation diseases, with confirmatory PK/PD data expected later this year. The partnership originated from a 2019 collaboration with Exscientia (now part of Recursion), combining RallyBio's rare disease expertise with Recursion's integrated AI platform. While RallyBio retains low single-digit royalties on future sales, the deal essentially represents a calculated retreat from a promising but resource-intensive program.

Berkeley startup emerges with $54.5M to restore kidney function using protein-folding therapeutics

Renasant Bio has raised $54.5 million in seed funding to develop disease-modifying treatments for autosomal dominant polycystic kidney disease (ADPKD)—the leading genetic cause of end-stage renal failure affecting 12 million people globally. Led by former 23andMe executive Emily Conley, the company is applying the successful corrector-potentiator approach pioneered by Vertex in cystic fibrosis to restore normal function of PC1 and PC2 proteins. While Vertex's own ADPKD corrector targets only 10% of patients, Renasant aims to address a much broader population with oral small molecules that can work across multiple mutations. The hefty seed round (co-led by founding investor 5AM Ventures alongside Atlas Venture, OrbiMed, and Qiming Ventures) reflects growing pharma interest in the space—Novartis recently paid $800 million for Regulus Therapeutics' ADPKD asset farabursen. The company plans to enter clinical trials within "a couple of years" as it progresses its lead corrector program through preclinical development.

Brain delivery specialist JCR lands Large Alzheimer's partnership worth up to $555M

Boston based Acumen Pharmaceuticals has inked a collaboration worth up to $555 million with Japanese specialist JCR Pharmaceuticals to enhance brain delivery of its experimental Alzheimer's antibody sabirnetug. The deal pairs Acumen's amyloid beta oligomer-selective antibodies with JCR's J-Brain Cargo platform—a transferrin receptor-targeting technology that aims to ferry therapeutics across the notoriously impermeable blood-brain barrier. Current Alzheimer's antibodies typically achieve only 0.1-0.5% brain penetration, requiring high systemic doses that increase side effect risks like ARIA. JCR's platform could potentially boost brain penetration 10-20 fold, allowing lower dosing with equal or superior efficacy. The collaboration follows more than a year of feasibility work (always a good sign), with preclinical candidate data expected in early 2026. Acumen—currently running a 542-patient Phase 2 trial with sabirnetug—will have an exclusive option to develop up to two candidates from the partnership. JCR's tech already has clinical validation via Izcargo, an approved enzyme replacement therapy for Hunter syndrome that was the first J-Brain Cargo product to reach market.

Opinion Piece: The Manchurian (drug) candidate

For the past few years we have seen an explosion of US pharma and biotech companies going “shopping for assets” in China. The rationale is that China is much more capital efficient than the US, has a looser regulation, and very much struggles to raise funds. The arbitrage thus became fairly obvious for companies needing to fill their pipelines: they have access to plenty of cheap capital in the US, China needs money and has (relatively) cheap assets. This arrangement was not going to last long since it has a lot of middlemen that create no value (all the folks that trade these assets need to be paid fat salaries), assumes that China will keep having bad capital markets (less and less true), and it leaves the actual value creation in the chain in China who will realize at some point, they don’t need the US (a la DeepSeek). However, the current US administration seems to have another view on these as “it’s stealing good american jobs”, a strategic risk to see another advanced industry leave the country, and a threat to the autonomy in the US. We saw what happened during COVID when masks were manufactured in China, imagine if it were the vaccines. Here comes the new FDA, which has already created a new accelerated approval voucher for “aligning with the national interest” (“buy american”), and is now expanding to blocking cell derived pharmaceutical products from China. The unspoken rhetorical question at hand seems to be ‘Why compete and solve structural issues when you can just hope that trade barriers will do the job?’ If this were to be applied, could you imagine living in a world with geolocked drugs ? It would be heartbreaking to tell a dying patient that the very real therapeutic that could save their lives is locked up by a trade embargo, but that is a scenario the US may find itself in years to come.

🗓️ Upcoming BiB Events

See our handy dandy Lu.ma event calendar HERE, please RSVP so folks can plan accordingly!

Supply Chain Logistics in Biopharma, Thursday, July 17th in San Francisco

Thank you to Eti Sinha and Shantenu Agarwal for organizing!

Minneapolis-St Paul Get Together, Thursday, July 24th

Thank you to Brian Repko for organizing!

📰 Top Community Conversations

@Max is looking into the intersection of AR/VR and lab operations

🏢 New Job Openings

Engineer/Data Scientist at Amass Technologies

Research Associate/Scientist at The Align Foundation

Senior/Staff Technical Project Manager at Stealth Cloud Health Data AI

🙋 🙏 Community Asks

Feedback: How is the Newsletter doing? We’re trying different formats/content. In case the hyperlink above didn’t get your attention, maybe a bright orange button will!

Volunteer: Want to get involved with Bits in Bio, meet new members across the community, and learn about the ecosystem? We are looking for volunteers to help us create great content and manage the community.

🙏 Thank you for being a BiB Weekly reader!

We want to deliver what matters most in Bio AI and would love your feedback on how we can do better. Please weigh in as anon here or DM me directly!