📢 Highlights

Arc Institute drops first virtual cell model trained on 270 million cells

FDA's radical priority program to cut approval process from 12 months to 60 days

Sanofi spends €545M on Formation Bio's JAK inhibitor and AI clinical engine

Not yet a member of our super awesome slack community of >9500? Join HERE 🤗

👀 In Case You Missed it …

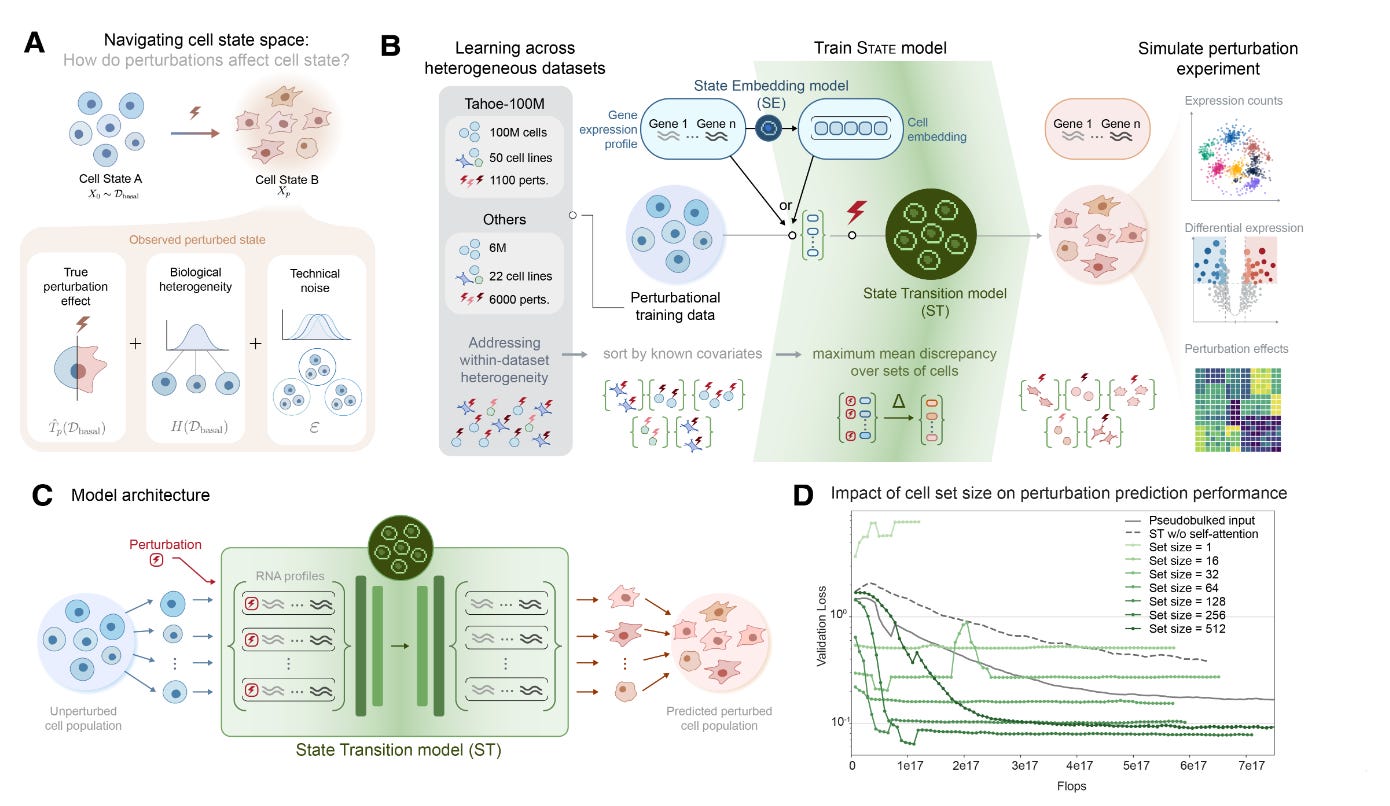

Predicting cellular responses to perturbation across diverse contexts with State

Researchers at Arc Institute have developed State, a transformer-based model that aims to predict how cells respond to drugs and genetic modifications across different cellular contexts, in an effort toward creating "virtual cells" for drug discovery. The model consists of two components: a State Transition model that learns perturbation effects across cell populations, and a State Embedding model trained on 167 million human cells to create robust cellular representations. The authors highlight that State outperforms simple linear baselines when generalizing perturbation effects to new cellular context. The preprint also comes with an interesting math deep dive into how the model is learning optimal transport mappings between cellular distributions. The work is positioned among efforts to scale virtual cell models that could help predict treatment responses without expensive laboratory experiments.

An updated priority review voucher program at the FDA

Priority reviews were a mechanism developed by congress, allowing a company to have an accelerated review of a drug of the company’s choosing, usually saving about 6 months to a year. This fast-track may seem short, but for a blockbuster drug, this means one more year of sales on patent that could bring in multiple billions of dollars per year. They used to be awarded for developing drugs for neglected tropical diseases, rare pediatric diseases, or “terrorism countermeasures”, as a way to incentivize companies to develop these socially useful drugs, even if they were not economically viable. Andrew Lo has an amazing talk explaining how they used to make some rare disease drugs viable to develop, even though the pediatric one no longer exists due to congress not renewing it in 2024. The new updated policy does not follow the previous policy and instead wants to reward companies for following the “agency’s priorities”, which is an extremely vague phrasing. This opens the door for rewarding companies that have allied themselves with the administration or sponsored a parade. This announcement also comes at the same time that the administration is negotiating its most favored nation pricing strategy, this is obviously a carrot to encourage companies to play ball, but one would be naive to not see that there is an implied stick: “it would be a shame if your new blockbuster was stuck in regulatory limbo for years”.Making the drug review process political is dangerous on multiple fronts: patronage is not science, some bad drugs may be pushed through the FDA, some good drugs may take longer to reach patients, and this introduces a new source of uncertainty in a biotech world that is already having a tough time right now…

Behind the Deal: Sanofi’s €545M Signal: Betting on JAKs, AI, and the Repurposing Playbook

Sanofi has signed a €545M ($585M) deal with Formation Bio to pursue a new indication for JAKsy (gusacitinib), a dual JAK/SYK inhibitor originally developed by Asana BioSciences. The asset, now in Phase 3 for chronic hand eczema under Formation’s stewardship, will be explored by Sanofi in a new, previously unstudied indication starting with a Phase 1 trial. The deal reflects Formation’s broader strategy: acquire or license underleveraged Phase 1–2 assets and run them through a tech-enabled engine built to compress timelines and reduce cost. Since rebranding from TrialSpark, Formation has leaned heavily into AI — deploying LLM agents to automate protocol drafting, trial site management, adverse event reporting, and recruitment optimization. Their in-house tools, like Muse (developed with OpenAI and Sanofi), promise faster, more targeted enrollment and regulatory workflows.

The deal also aligns with Sanofi’s broader immunology strategy — from its IL-4/13 dominance with Dupixent to its pipeline expansion into TYK2 and other JAK pathway assets. It underscores the growing trend of partnering around repurposed or de-prioritized Phase 2–ready programs, offering speed-to-market advantages without the full R&D burden.JAKsy now becomes a bellwether for how AI-enabled platforms might reshape the economics and tempo of immunology drug development — though recent Fierce Biotech and STAT reporting has cautioned that many AI-first biotechs still face translation gaps between automation promise and clinical execution.

Alphabet spinout unleashes SAIR dataset to predict drug binding 1,000x faster

SandboxAQ, the AI startup that emerged from Google's quantum computing sandbox and counts Nvidia among its backers, just released SAIR (Structurally Augmented IC50 Repository) - a massive dataset of 5.2 million computationally generated 3D molecular structures tagged with real-world experimental potency data. The company leveraged Nvidia's DGX Cloud to generate synthetic protein-ligand pairs that haven't been observed in the lab but were calculated using physics-based equations grounded in experimental data. This approach sidesteps the traditional data bottleneck in drug discovery where researchers struggle to find enough quality training data for their AI models. While SandboxAQ is making the dataset freely available to researchers, they're betting their proprietary Large Quantitative Models (LQMs) trained on this data will become the go-to tool for predicting whether small molecules will stick to their protein targets - potentially reducing what takes months of lab work to mere hours of computation. The move represents a shift from traditional AI approaches that rely on pattern matching to physics-informed models that understand the underlying molecular mechanics.

Illumina pays $425M for SomaLogic’s proteomics unit — but is it too little, too late?

Illumina is acquiring SomaLogic’s proteomics business from Standard BioTools for $425M in stock, adding a high-throughput aptamer platform to its multiomics playbook. The move expands Illumina’s reach beyond sequencing, with the business generating ~$80M in 2023 revenue and projected to turn profitable by 2027.But analysts are split. While some called the price “reasonable,” others flagged the timing: Thermo Fisher’s $3B acquisition of Olink, now powering the UK Biobank’s 600K-sample proteomics effort alongside Ultima Genomics, suggests Illumina is arriving late to the proteome land grab. Integration risk also looms, with investor concerns around execution and dilution. Illumina is betting it can leverage NovaSeq X and DRAGEN to cross-sell into its existing base — but with Olink already scaling fast, the question is whether this deal extends Illumina’s lead or just helps it play catch-up. The genomics and multiomics market is ripe for consolidation — expect more strategic deals ahead.

AI scribe unicorn Abridge hits $5.3B valuation with $300M Series E

Abridge just closed a $300 million Series E led by Andreessen Horowitz at a $5.3 billion valuation, bringing its total raised in 2025 to $550 million across two rounds. The Pittsburgh-based startup's ambient AI platform now serves over 150 health systems including Kaiser Permanente, Mayo Clinic, and Johns Hopkins, and is on track to process 50 million medical conversations this year across 55 specialties and 28 languages. What sets Abridge apart is their new Contextual Reasoning Engine that doesn't just transcribe - it takes into account revenue cycle requirements and generates documentation that's both clinically useful and billing-compliant at the point of care. The technology addresses a massive pain point where U.S. healthcare burns $1.5 trillion annually on administrative costs, much of it tied to the complex dance between clinical documentation and revenue cycle workflows. With their models having "gone to coding school, risk adjustment school, and utilization management school," Abridge is positioning itself as the intelligence layer that captures the right information during the conversation rather than forcing physicians to become billing experts after the fact.

General Catalyst pre-funds Commure's sales and marketing in exchange for customer revenue share

Commure has secured $200 million in growth financing through General Catalyst's Customer Value Fund (CVF) - a creative structure where GC pre-funds sales and marketing efforts in exchange for a capped share of acquired customer revenue, letting Commure scale without dilution or balance sheet risk. The healthcare AI infrastructure company, which now serves 130+ health systems and has doubled its ARR for three consecutive years to north of $200 million, is using the capital to meet surging demand for its full-stack platform spanning revenue cycle management, ambient AI documentation, and practice management. This marks a notable evolution in GC's healthcare AI strategy after their spectacular failure with Olive AI, the $4 billion automation startup that shuttered last year. Commure's been on an acquisition tear, scooping up Augmedix for $139 million and Memora Health more recently, while co-developing the nation's largest ambient AI rollout with HCA Healthcare. CEO Tanay Tandon expects IPO readiness within two years and cashflow positivity by mid-2026, though the company faces stiff competition from EMR giants building their own AI tools. The CVF structure essentially lets Commure offload S&M expenses while maintaining engineering investments on their balance sheet - a bet that their AI agents for billing workflows, clinical documentation, and patient engagement can capture meaningful share before Epic and others catch up.

Biotech startup's computational approach targets flu's "Achilles' heel" sites that resist mutation

Centivax is pushing forward with its universal influenza vaccine candidate Centi-flu, which uses a clever "epitope focusing" technique to train the immune system on conserved viral regions that haven't changed since the 1918 pandemic. The South San Francisco-based startup, founded by Netflix's "Pandemic" documentary star Jacob Glanville, mixes ten representative flu strains dating back over a century but dilutes them so only the shared, conserved sites generate an immune response - essentially forcing antibodies to target the virus's evolutionary constraints rather than its mutable surface proteins. In preclinical studies, animals immunized with Centi-flu showed broad neutralizing antibodies spanning over 100 years of influenza evolution, including protection against the currently circulating H5N1 strain with pandemic potential and variants that didn't exist when testing began. The approach leverages computational immunology to identify these "Achilles' heel" sites that viruses can't easily mutate without losing their ability to infect cells. With backing from CEPI, Gates Foundation, NIH, and military research centers, Centivax is preparing for Phase 1 trials while also applying the same platform technology to COVID-19 and HIV vaccines - chasing the holy grail of broad-spectrum protection against rapidly mutating pathogens.

🗓️ Upcoming BiB Events

See our handy dandy Lu.ma event calendar HERE, please RSVP so folks can plan accordingly!

San Francisco Biomixer Deeptech 2025, June 25th at 5 pm

Seattle Summer Biotech Happy Hour | BioBeers & Bits in Bio, June 27th at 4 pm

📰 Top Community Conversations

@Felix Notes the shift of US VC's to funding chinese clinical stage spin outs

link to post

🏢 New Job Openings

Software Engineers at Convoke

Senior Experimental Scientist, Plant Biology at Biographica

Image Data Engineer at E11 Bio

Founding Software Engineer at Tatta Bio

Postdoctoral Fellow at The Institute for Computational Cancer Biology

🙋 🙏 Community Asks

Feedback: How is the Newsletter doing? We’re trying different formats/content. In case the hyperlink above didn’t get your attention, maybe a bright orange button will!

Volunteer: Want to get involved with Bits in Bio, meet new members across the community, and learn about the ecosystem? We are looking for volunteers to help us create great content and manage the community.

🙏 Thank you for being a BiB Weekly reader!

We want to deliver what matters most in Bio AI and would love your feedback on how we can do better. Please weigh in as anon here or DM me directly!